In the previous article in this series, we pointed out that every currency trader would have his or her own specific needs in terms of software, broker and currency trading information. In the same way, your currency-trading computer should have a direct correlation to your trading plan. If you are an investor or swing trader, your computer needs are not as demanding as a scalper or day trader. It’s very similar to how your broker and your trading plan must be supportive of your particular currency trading style. If the same solution applied for everyone, there wouldn’t be a market. Thank goodness for the differences we each possess!

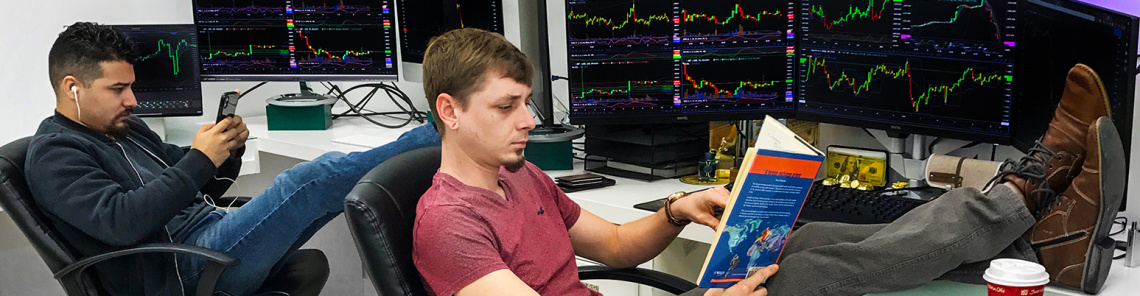

Your currency trading computer must be able to perform (and perform well) during the most crucial and hectic times of the day when you are putting on trades and following your trading strategies. The majority of brokerage software and charting applications take an incredible amount of computing power. You may be thinking “But the minimum specs on their website seem very low“. Usually that is only the specs needed to install the application; minimum specifications listed by brokers and software vendors do not taking into account all of the other variables that are different for every trader. What other applications do you have open; how many charts do you have open; how many order entry and level II market depth bars do you have; how many monitors do you have operating; and how many strategies and indicators do you have computing the data and transforming them into easy to read visual and graphical formats.

Consider RealTick, a feature rich software vendor, for example: In their manual you can read that the minimum specifications are that you must have a Pentium II and 128mb of RAM. How many traders do you know that would ever consider functioning with only 128mb of RAM?

Let’s consider a combined broker and software package for example, Tradestation. Their minimum system requirements are Pentium II 450Mhz and 256mb of RAM. Yet on the very next line, under “recommended system requirements” it states that you want to use the fastest processor available, as much RAM as possible, as large of a hard drive as possible, and the fastest video cards available. Wow, are those recommendations different from the minimum or what? Aren’t they a bit broad? Don’t you love how they aren’t specific at all? Their job is to make sales and develop and grow new accounts, not worry about whether or not their client’s computers are setup properly for their software; that isn’t their problem, it is yours.

The bottom line on all this is that the total system must be able to perform as you wish it and not be running into continuing constraints. First, you need to ask yourself what type of trader you are. How many trades do you go through on a monthly, weekly and daily basis? What is the average time frame that you hold a position? How many different software applications do you run throughout the trading day? The answer to each of these questions will have a direct effect on what your needs truly are for your currency trading computer system.

In the next article we’ll look at some of the important elements in your ideal currency trading computing system.

The author, Jordan Peterson, of Custom Trading Computers, Inc. is a well-known expert in custom built high performance computers, which must be specifically designed for currency traders. Such computer systems can handle heavy volume trading periods with complete success and without any danger of locking up.